As the White House begins to change over its residences, let's take a look at the requirements one must take to change their state of residency and the state tax implications involved. You may have wealthy, older age clients from high tax states considering a move to a lower-taxed state to save money. This typically involves state income taxes on retirement benefits and state estate taxes on net worth/gross estates.

A quick look at the state income taxes on retirement benefits:

- Source Tax Relief, a federal law established in 1996, prevents states from taxing former residents on distributions received from any qualified retirement plans after they become legal residents of another state.

- Qualified Retirement Income is defined as distributions from employer-provided pension plans under IRC Section 401 ( Defined Benefit, Profit Sharing, 401(k)), Simplified Employee Pensions (SEP) under IRC Section 408, and IRC Section 457(b) "eligible" plans for non-profit or government employees.

Facts to know about state estate taxes that apply to a person's residency at death:

- Impacts individuals in states that levy state estate taxes at the death of a legal resident

- About 18 states currently tax the gross estate of an individual at death

- The majority of the states are in the Northeastern part of the U.S.

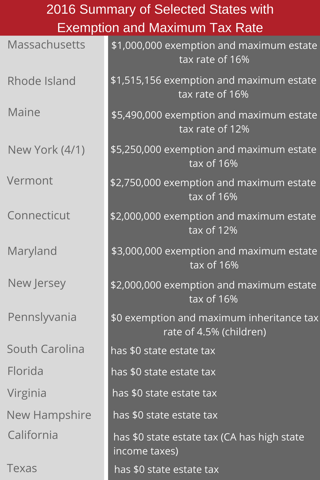

- Tax rates progressively range from about 6% to 16% with a variety of state exemptions

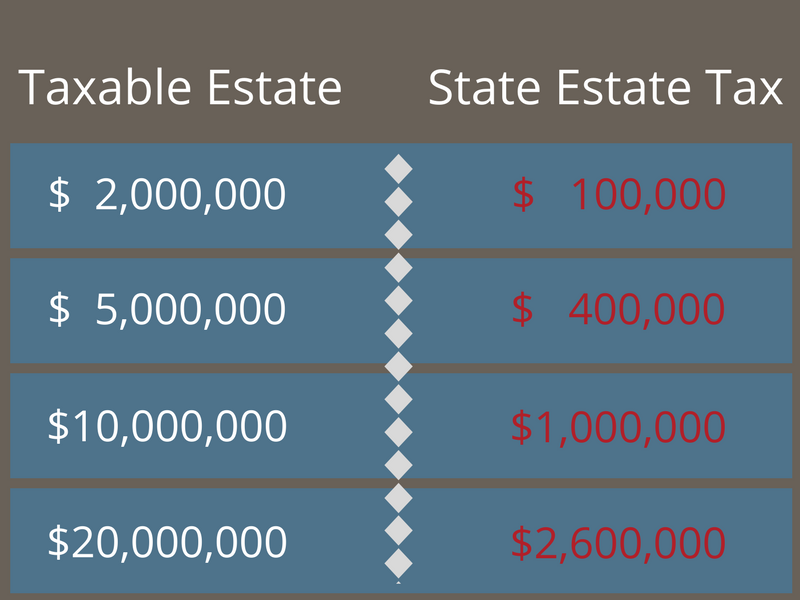

Below is an example of how a taxable estate would generate state estate tax. The key factor in determining this amount comes down to the state of legal residency. An advisor should help their clients to understand how this works and include this practice in their estate planning checklist.

Learn More: A Brief History of Estate & Gift Taxes

Based on the corresponding state income taxes and state estate taxes, certain individuals and couples may decide it's in their best interest to permanently move to a state with lower taxation. States with zero income taxes on retirement benefits and estate taxes would be particularly favored as choices for permanent residency (i.e. Florida, Texas, Nevada, New Hampshire, Alaska, South Dakota, and Wyoming). Many of these states are found in the Northeastern part of the U.S. Generally, the tax rates progressively range from about 6% to 16% with a variety of state exemptions.

Note #1: New York and Maryland are in the process of phasing in an increase in their state death tax exemptions over the next few years. The New York and Maryland exemptions will be equal to the federal estate tax exemption by 2019. New Jersey will repeal its state death taxes starting in 2018.

Note #2: Keep in mind that real estate owned in the former state will still be subject to state estate taxes at death. Rental income and capital gains upon any subsequent sale of the property will be subject to taxes in the former state as well.

How does a person become a legal resident of a new state?

Many states determine tax residency by looking at a person’s domicile or place where the individual has the closest connections. As a subjective test, state courts and tax authorities will consider many factors to determine residency for tax purposes. Here is a list of some of those important factors:

- The location of the individual’s principal residence and whether the residence is owned or rented. If an individual has more than one residence, the courts and tax authorities will look at where the individual keeps personal belonging, lives with family, and intends to live indefinitely

- Time spent in the new state versus the old state

- Location of the individual’s spouse and children

- The state in which the individual’s car is registered

- The state issuing the individual’s driver’s license

- Where the individual is registered to vote

- The location of the individual’s bank accounts

- The location of the individual’s brokerage accounts and the origination point of the individual’s financial transactions

- The location of health care providers like doctors and dentists

- The location of accountants and attorneys

- Location of a place of worship or social and country clubs of which the individual is a member

- The location of real estate

- Address listed on Form 1040 U.S. Income Tax return

- The location of any safe deposit boxes

- Where estate planning documents have been executed (i.e. wills, revocable trust, durable powers of attorney)

Generally, the facts and circumstances based on the list above will determine in which state the individual is most closely associated. It is the strength of those connections created in the new state which will ultimately determine residency for state tax purposes.

Your clients who are considering moving to a new state should have a plan of action to sever connections with the old state. A successful change of residency can save hundreds of thousands (or even millions) of dollars in combined state income taxes and state death taxes.

Keep in mind that no matter which state your client is seeking to establish residency for state tax purposes, federal income taxes will still be due and payable on their retirement benefits. Gross estates in excess of the federal exemption amount will still have federal estate taxes due and payable no matter where their assets and property are located in the U.S.

Have questions or want more information on a particular client? Contact Brokers' Service Marketing Group at (800) 343-7772.