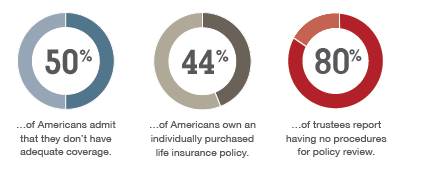

DID YOU KNOW?

It is a common misconception by consumers that once a life insurance policy is purchased they can "set it and forget it."

Has your life changed in the last five years, how about the last two years? I don't need to tell you how quickly life can change. Your client's lives are also continually evolving, so shouldn't their life insurance protection be reviewed to match? Use these life insurance sales tips to keep in touch with your clients and ensure their current policy still matches their needs.

Life is busy, your clients may (or may not) be aware that they need to update their policy coverage. They also may not have the time to research new products or even to pick up the phone to call you for help. Be proactive and check in with your clients. Do they have a new career, business, child or home? The simple question of "when was the last time someone reviewed your policy?" may be all you need to open the door.

Think about it this way - if your car dealership calls you offering a free oil change, you are likely to take advantage. So offer a policy review to your clients and prospects. What's the worst they can say?

A policy review provides you an opportunity to reconnect with new and existing clients. For clients, you can see what changes have occurred in their lives, and for referrals and prospects, it can be an eye-opening review. Many advisors avoid policy review, so this is a chance to talk about whether or not the life insurance policies purchased are still the right fit, policy type, and coverage amount to meet their needs. Reviewing policies and making sure your clients’ coverage is still appropriate is as—and in many ways more—important than the initial policy they purchased.

That’s because life changes, but a life insurance policy may not keep up with changes in needs. A successful policy review will:

- Examine life changes

- Analyze current policy performance

- Locate coverage gaps

- Offer suggestions to fill those gaps

- And, offer a new coverage framework that reflects their current needs

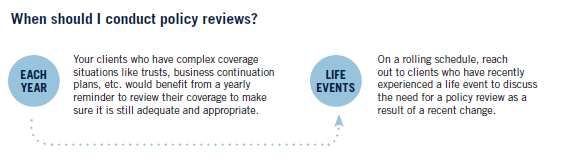

Policy reviews can drive new business for you, but only if you actively seek out clients and conduct the reviews. Most likely, a client will not approach you and request a review.

Target Client Profile

Clients who may have coverage gaps and could benefit from a policy review include those who have:

- Recently purchased a home

- Recently married

- Added a new member to the family

- Recently retired and are interested in estate planning

- Started or continue to grow a business

- Recently received a promotion or changed jobs

Also, consider those who have:

- College-age children

- Elderly parents who are or may become dependent on them

- Concerns about becoming chronically ill in retirement

- Different financial goals than in the past

Conversation/Talking Points

Plan to build policy and client reviews into your weekly sales efforts. Consider these talking points as a guide when you reach out to your group of selected clients or prospects about conducting policy reviews:

- “I noticed your policy is X years old. There have been some changes in the market and new products are available, it's in your best interest for us to review your policy. I can answer any questions you may have, make sure the policy is on track, and ensure the beneficiaries listed are still correct.”

- “Life changes—I know my life is very different from when I sold you your life insurance policy. I’d like to get together to review your coverage and needs to ensure your policy will still adequately protect you and your loved ones.”

- “Since you purchased your policy, I noticed you have experienced a life-changing event, [having children, getting married, or purchasing/selling a home]. We should look at your current coverage amount to see if it is still meeting your needs.”

- For your clients who may not have a life insurance policy with you: “Do you have any life insurance coverage outside of what your employer may offer? If so, how has your life changed since you purchased this coverage? When was the last time you reviewed this policy? Is your life insurance still enough to cover you and your loved ones? I’d like to take some time to review your protection needs with you.”