Whether purchased for accumulation, retirement income or for the death benefit, life insurance has many tax benefits. With tax season in full swing, there's no better time than the present to educate your clients on the unique tax advantages associated with owning a life insurance policy.

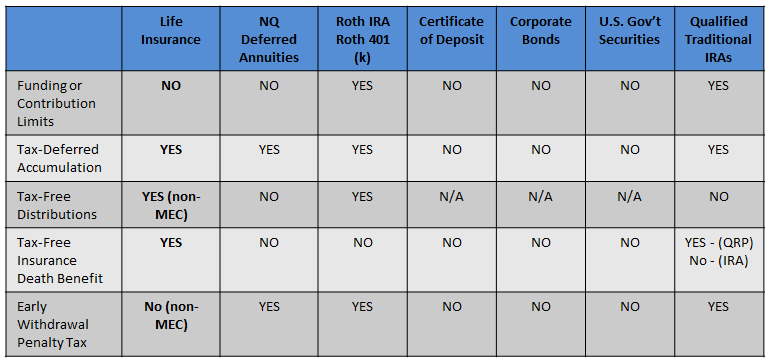

We asked our in-house tax expert for a summary of the tax advantages of life insurance versus other asset types including; IRAs, NQ Deferred Annuities, Corporate Bonds and U.S. Government Securities. These are the top 6 tax advantages worth discussing with your clients.

Top 6 Tax Benefits of Life Insurance:

- Life insurance premiums are paid with after-tax dollars: Generally, premiums are not a tax-deductible expense.

Dividends from life insurance can also be used to purchase paid-up insurance additions tax-free. Similarly, the cash value of the paid-up additions accrues tax-deferred. - Tax-deferred cash value accumulation: Growth of policy cash value in excess of the cost basis is typically income tax-deferred while it remains in the policy.

Cash value policies are subject to a “seven pay test,” as a way to measure the limit that the Internal Revenue Code (IRC) can place on the amount of premiums that are put into a life insurance contract. It limits the usual FIFO tax benefits of cash value withdrawals. Any policy that fails this test is classified as a Modified Endowment Contract (MEC) and withdrawals are taxed under the LIFO rules.

- FIFO tax-free distribution: For non-MEC policies, cash can be withdrawn from the policy tax-free up to the adjusted cost basis. Some cash distributions received, due to certain changes in the death benefit of a contract, may not be taxed under the FIFO cost recover rule. However, these could be taxed under the LIFO rule. For a full definition of what constitutes as earlier determination or adjustment, check the life insurance guidelines of the IRC Section 7702.

- Tax-free death benefit: IRC Section 101(a) provides that death benefits of life insurance are income-tax-free when paid to the policy beneficiary. If the life insurance policy is owned by someone other than the insured, the death benefit is taxed as if the insured were the owner of the policy. That is, the death benefit is income tax-free under the IRC Section 101.

- No deposit limits: There are no restrictions on the total amount that can be placed in a policy versus QRP/IRA Limits (see chart below). For this reason, life insurance policies are a popular financial asset to pass funds along to the next generation. Often the value of a life insurance policy, for a gift tax purpose, is the interpolated terminal reserve plus any unearned premium. A Form 712 Life Insurance Statement should be obtained from the carrier.

- Life insurance included in an insured's gross estate: The death proceeds of life insurance can be included in an insured’s gross estate in the following three circumstances.

- The proceeds are payable to the insured’s estate, or are receivable for the benefit of the insured’s estate;

- The proceeds are payable to a beneficiary other than the insured’s estate, but the insured possessed one or more incidents of ownership in the policy, whether exercisable by the insured alone or only in conjunction with another person;

- The insured has made a gift of the policy on the insured’s life within three years of his or her death.

Now Let's Compare

Consider these tax advantages (or disadvantages) when funding a portfolio for retirement income or for leaving an inherited legacy for heirs.

Remember, it's the AFTER-TAX INCOME STREAM that's important. In other words, focus on what your client gets to keep after payment of income taxes, both during the accumulation and distribution.

As you can see, life insurance has the flexibility to satisfy multiple financial needs that help protect, accumulate, and transfer wealth. Based on the income tax results described above, your clients may have more to consider when making a decision regarding life insurance than they think.