6 Steps To Building A Successful Life Insurance Sales Strategy Using the "Balanced Approach"

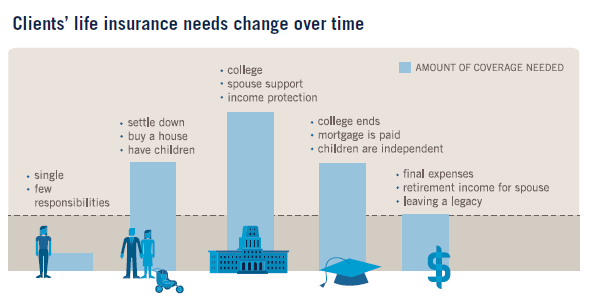

Most of your clients face a dilemma as they find their life insurance needs shifting. They can either:

- Insure their highest level of coverage needed, even though it could be years from now, or

- Insure their lowest level, all but guaranteeing they’ll be under-insured in the future.

Whether they are clients who are considering buying insurance for the first time or ones who realize that their current policy isn’t enough, finding the right balance is an important concept.

Protecting Short and Long-Term Needs Efficiently and Economically

Rather than use one policy, your clients can purchase a term policy and a permanent policy; this can be called a "Balancing Act" or the "Balanced Approach" to life insurance. The latter provides a base to address long-term protection needs while the former adds protection only while it’s needed. Combining term and permanent policies is less expensive overall than buying one permanent policy with a higher level of coverage or having to buy a second term policy later in life after the first ends.

For another alternative see: Ladder Coverage With Term Riders: Have a Pitch in Your Back Pocket

To Address These Needs, Try This 6 Step Action Plan for Success

- Review Clients & Prospects: The most successful way to approach the "Balancing Act" concept is to focus on 10 clients or prospects at a time. Follow each step below with those 10 clients then select 10 more and repeat!

- Send a Letter or Email: Contact the client or prospect to introduce them to this idea and to set up a meeting. Send a letter or email to 10 clients or prospects to introduce the "Balancing Act" concept. You can use the prospecting letter we've created along with our Term Conversion Comparison Chart.

- Follow-up Phone Call: Follow up your letter or email with a phone call to check in with the client or prospect, ensure he or she got your email or letter and ask for a meeting to discuss the concept further.

- Prepare for a Meeting: Once a meeting is scheduled, the focus shifts to what’s needed to present the strategy and help them decide on a course of action. Conduct a life insurance needs analysis in preparation.

- Client Appointment: Talk to your clients about the advantages of a balanced approach to life insurance using these points:

- Combining term and permanent policies is less expensive: "Blending term and permanent coverage is generally less expensive than buying a permanent policy alone for the same amount of coverage or buying a new term policy later in life."

- Reducing costs: "Both types of insurance are usually less expensive the younger and healthier you are when you purchase them. Buying one policy first and then another later generally means you’ll pay more for the second than if you’d bought both at the same time because waiting until you’re older will increase the costs."

- Locking in coverage: "Your insurability is “locked in” with the permanent coverage. If your health declines, you’ll still have valuable life insurance protection in place at a time when the cost of a new policy may be prohibitive or you could be unable to qualify for a new policy."

- Ease of conversion: "If you need more permanent insurance at a later time, you might be able to convert part or all of your term coverage to permanent, without another medical exam."

- Supplement your income: "Some permanent policies, in addition to the death benefit, potentially accumulate cash value, which can be used to supplement your income."

- Combining term and permanent policies is less expensive: "Blending term and permanent coverage is generally less expensive than buying a permanent policy alone for the same amount of coverage or buying a new term policy later in life."

- Follow-Up: Always follow up with the clients to collect all of the necessary paperwork if they have decided to purchase a policy or to continue discussing the strategy if needed. Following up with a call and an email can help increase your close rate.