LTC Conversation: Guide to Comparing Coverage Options

Has this ever happened to you? Towards the end of a meeting or phone call with your client, the conversation naturally drifts to other topics. In this instance, your client mentions being overwhelmed by the process of finding an assisted living facility for a parent facing health issues.

While your client was aware that LTC costs could be high, they were shocked when they saw the current costs. Long term care coverage had always been something your client meant to consider, but now it is urgent.

Between standalone LTC coverage, LTC riders, hybrid policies, terminal illness riders and Accelerated Benefits Riders (ABRs) there is a tremendous amount of information to digest. Luckily, the BSMG case design team can help you sort through all the options to deliver the best solution for your clients.

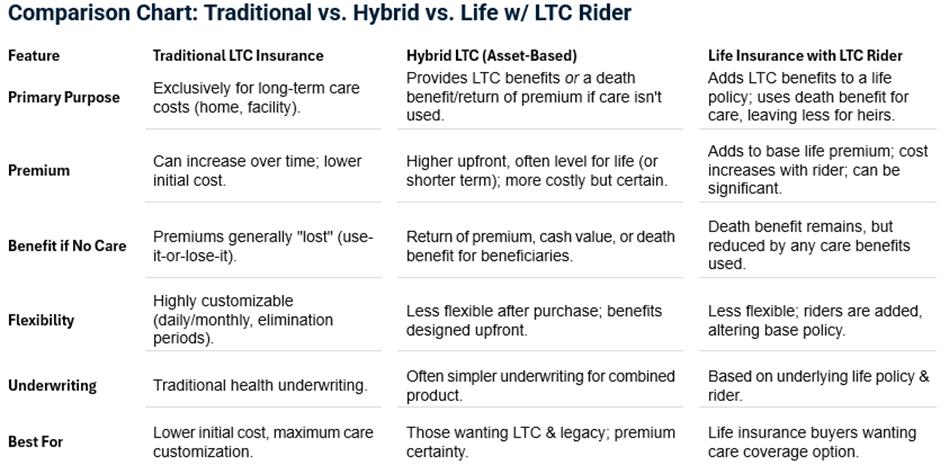

There are three main options for LTC coverage:

- Traditional LTC Insurance;

- Hybrid LTC (Asset Based); and

- Life Insurance with LTC Rider.

Traditional LTC Insurance: There are a limited number of carriers that provide this option. It only covers long term care costs and is usually funded on an all pay basis. Premiums and/or benefits are not guaranteed and if coverage is unused the premiums are gone – use it or lose it. This is purely an LTC protection product.

Hybrid LTC Insurance or Linked Benefit Insurance: This combines LTC benefits with life or annuity coverage depending on the product solution and can be funded for specific product durations - 1, 5, 10, 15 years, age 100. It also accepts 1035 rollovers from other existing life/annuity products. These options pay LTC claims if needed but provide a death benefit to heirs if not used.

Life Insurance with LTC Rider: This is a life insurance product design with an optional LTC rider added. The focus is on death benefit but if the client experiences an LTC need they can advance a portion of the death benefit to cover LTC costs. Amounts not used for LTC pass to the beneficiary as a death benefit.

The chart below shows a comparison between the three options.

The best place to start this LTC conversation is by gathering information about the client's needs, goals, and assets:

- Is there a death benefit need, or is covering LTC costs the primary focus? If the main priority is death benefit, then Life with an LTC rider should be the focus. If the client wants LTC with growth and longer benefit periods, a hybrid LTC product would be more appropriate. For a younger client, an increasing benefit is usually attractive.

- Do they have an inforce policy with cash value that can be repurposed?

- Will the client have changing budget restrictions and need premium flexibility? Client age and payment duration are critical factors here. The older the client, the more limited the options become. Age helps us determine the available options and the pay periods offered. Life with a rider is the most flexible when it comes to premium pay periods. Hybrid/LTC may be limited to 1, 5, 10, or 15-pay or life pay based on issue age.

With these basics as a starting point, BSMG can build designs using different options to assess the benefits and drawbacks of each:

Monthly benefit need or starting premium: Determine the monthly benefit needed for LTC or determine the premium the client wants to pay to start. Most cases require a second run after the initial premium since costs can be more than the client expects to pay. We need to stay within their budget.

Duration of benefit: This is sometimes driven by either the agent's or the client's experience with an LTC claim. Most life policies pay a 2% of face amount LTC benefit for 50 months. Hybrid/LTC policies can be designed for as little as 2 years to a maximum lifetime benefit.

Married/couple considerations: If the client is married or part of a couple, ask if they want individual coverage, a shared pool of months, or something unlimited. Different products and carriers are available for each option.

I find it helpful to discuss these types of cases with the advisor to fine tune the design and explain the differences. We can also illustrate both designs and help explain the pros and cons of each option.

Let’s review a sample case that BSMG recently worked on. The request was for $15,000 a month in Long Term Care Benefits on a 60-year-old male and a 58-year-old female. These clients have a family member in a facility who has been under care for almost 4 years. The advisor wanted a level premium on a lifetime basis to keep the premium lower. He did not have a premium commitment yet but was asked by the client to provide $15,000 a month in LTC benefit. The advisor wasn't sure if a death benefit was needed, but he preferred life policies with LTC riders because he was unfamiliar with how hybrid LTC products worked. This scenario required running both product types. I won't get too deep into product specifics here, since the available options - UL, IUL, GUL, and SUL - could easily fill another ONE Idea.

The Life Insurance with Rider Design: to obtain $15,000 a month for 50 months we need a policy death benefit of $750,000 for each client.

- 60-year-old male client, Preferred, $750,000 with LTC rider. Annual premium would be $12,900 per year.

- 58-year-old female client, Preferred, $750,000 with LTC rider. Annual premium would be $10,219 per year.

- Survivorship IUL guaranteed to age 105. Provides $15,000 a month of benefit for each client for 50 months. Annual premium would be $23,573 per yr.

The Hybrid/LTC Design: obtain $15,000 a month benefit for 5 yrs. This option doesn’t offer a 50-month choice, and the client wanted more than 4 years of coverage due to their recent LTC claims experience.

- 60-year-old male client, 5 year benefit without inflation. Annual premium is $13,503

- 58-year-old female client, 5 year benefit without inflation. Annual premium is $12,946

- Joint Hybrid LTC product with a 96 month shared pool benefit. Annual premium is $18,027

- Joint hybrid LTC product with a lifetime benefit available for each client. Annual premium to age 95 is $20,340

These are just starting numbers, but they offer plenty to review. Here are some key observations:

Life Insurance with LTC Rider:

- The death benefit is fixed to obtain the $15,000 monthly benefit

- We can shorten the solve age or pay period, but the client will need $750,000 of death benefit to obtain $15,000 per month for 50 months.

Hybrid Policy:

- Has a more fixed premium structure, but we can save some money by starting with a lower monthly benefit and adding inflation protection.

- Would allow us to obtain $15,000 a month at a future point - for example, $15,000 a month at age 70, with the benefit continuing to grow each year.

- An inflation strategy can be built into a hybrid LTC design but not a life with LTC rider.

I have not seen many cases sold with a $15,000 a month benefit - the premium may be too high for most clients. BSMG can scale these back to smaller policies that fit into the client’s budget.

For hybrid LTC products BSMG has carrier prequalification information that may help you determine if your client qualifies for coverage. We can also submit quick-quote requests to carriers, as needed, on any medical issues.

There are many ways to illustrate LTC and Life coverage. The first step is determining what the client ultimately wants to protect. This requires collecting information about budget, benefit requirements, and any underwriting concerns.

Contact your BSMG Wholesaler or the BSMG Advanced Markets Team at 800.343.7772 for more information or to discuss a case.

.png?width=1170&height=202&name=24th%20Annual%20Charity%20Invitational%20(35).png)