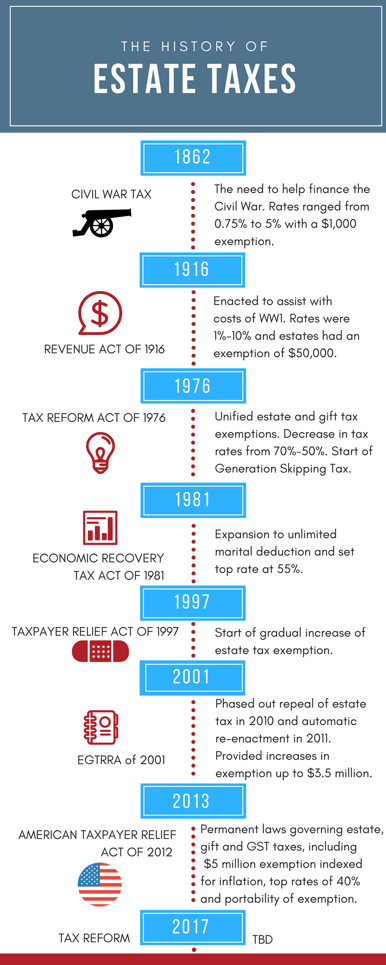

Estate and gift taxes have provided a source of revenue for the United States government for over 150 years and have had many variations. Now that we'll have a Republican president and a Republican majority in the Senate and House of Representatives, what's in store for the future of these taxes? To fully understand how Estate and Gift Taxes could be affected by the political and economic environment, let's take a look at a brief history of how these taxes have evolved.

The estate tax was established by Congress to help subsidize and fund wars like the Civil War and the Spanish-American War. Once these wars were over the estate taxes were repealed.

The Revenue Act of 1916 was enacted to offset some of the costs of World War I. The rates ranged from 1%-10% and estates had an exemption of $50,000.

Congress soon found people using a loophole by transferring their assets during their lifetime to avoid estate taxes at death. To eliminate this Congress enacted the Gift Tax in 1924 and made gift taxes permanent in 1932.

1948 marked a pivotal moment for estate taxes with the passing of the marital deduction rule. This allowed an individual to transfer one-half of their estate to their spouse without any estate tax.

Estate tax reform really started to accelerate in 1976 with the passing of the Tax Reform Act (TRA). The law combined gift and estate taxes to impose a single unified credit on lifetime and testamentary transfers. This legislation decreased top estate tax rates and created the generation-skipping transfer tax (GST).

Not long after came the Economic Recovery Tax Act (ERTA) in 1981. The Act expanded the marital deduction to 100% and permitted spouses to transfer property deemed to be qualified terminable interest property (QTIP).

These estate tax rules remained in place until 1997 when the Taxpayer Relief Act was passed. This Act increased the unified credit gradually, and started indexing for thresholds and limits like the annual gift tax exclusion.

In 2001 the Economic Growth and Tax Relief Reconciliation Act (EGTRRA) was passed by Congress through the budget reconciliation process. Many associate this law with a major change in estate taxes that allowed for a gradual increase in estate tax exemption from $1 million to $3.5 million by 2009.

Notably, EGTRRA repealed estate taxes in 2010 by eliminating all estate taxes for anyone who died during this time. Congress quickly passed the 2010 Tax Act reinstating the estate and GST tax in 2011. This Act applied a maximum 35% estate tax and increased the exemption to $5 million. This law was only in effect for two years.

The American Taxpayer Relief Act (ATRA) of 2012 permanently enacted laws governing estate, gift and GST taxes. This legislation installed a $5 million exemption indexed for inflation and a top rate of 40%. This also made portability permanent, which enabled a surviving spouse to add their deceased spouse's unused estate tax exemption to their own.

What does the future hold for estate and gift taxes? Looking at the brief history indicates there is likely to be reform of estate taxes as new economic and political realities emerge. With a Republican controlled government, major tax reform could go into effect next year. The proposed plan by President-elect Trump is to repeal estate, gift and GST taxes. Stay tuned for tax reform legislative updates in 2017.